E-Wallet Evolution: Navigating the Cashless Era

Text us your thoughts on the podcast

There are many risks inherent in the switch to a cashless society. However, with the change being considered all but inevitable, it becomes crucial for all organizations involved in the economy to work together responsibly and make sure no person is left behind and the vulnerabilities in a cashless system cannot be exploited by those with nefarious intentions.

supporting links

1. Pymnts Intelligence [website]

2. Stolen Device Protection [Apple]

3. 1Password [website]

4. Bitwarden [website]

5. What is a Digital Wallet? [Investopedia]

6. Cashless society [Wikipedia]

7. Are We on the Verge of a Cashless Society? [Tech.co]

Contact That's Life, I Swear

- Tweet us at @RedPhantom

- Listen to audios:

-Apple https://apple.co/3MAFxhb

-Spotify https://spoti.fi/3xCzww4

-My Website: https://bit.ly/39CE9MB - Email us at https://www.thatslifeiswear.com/contact/

- Music and/or Sound Effects are courtesy of Pixabay

- If you like to leave a review for an episode, please submit on Apple Podcast or on my website

- Do you have topics of interest you'd like to hear for future podcasts? If so please email us at: https://www.thatslifeiswear.com/contact/

Thank you for following the That's Life I Swear podcast!!

10 min read

Let me cut to the chase. Carrying a wallet is just plainly uncool now. It’s time to go digital. Picture this: a world where your bulky wallet is a relic of the past, replaced by the sleek convenience of your smartphone. Sounds enticing, right? Navigating a cashless society isn't all smooth sailing. Today we explore the ins and outs of embracing a wallet-free lifestyle, uncovering the secrets to success, and the compromises it demands. Get ready to ditch the old and embrace the new, because the digital revolution is here!

Welcome to That's Life, I Swear. This podcast is about life's happenings in this world that conjure up such words as intriguing, frightening, life-changing, inspiring, and more. I'm Rick Barron your host.

That said, here's the rest of this story

For many of us, the trusty wallet tucked into our back pocket or purse serves as the repository for all crucial possessions. Whether it was cash, identification, or credit cards, it held the essentials for immediate access.

However, the era of the bulging wallet loaded with money, plastic cards and other is swiftly going away. The contemporary preference today leans heavily towards the streamlined efficiency of a digital alternative.

Enter the realm of digital wallets, a domain that has witnessed exponential growth in recent years. The introduction of Apple's digital-centric credit card, the ubiquity of the phrase "just Venmo me," and the convenience of using a smartphone or smartwatch to navigate mass transit exemplify this shift.

By 2022, a staggering 89 percent of Americans had embraced some form of digital payment, with a significant portion anticipating the adoption of a digital wallet within the next couple of years, as per findings from a McKinsey & Company study.

For those hesitating to embrace digital wallets for their financial transactions, a comprehensive understanding of what they entail, their functionality, and their security measures may offer reassurance.

The mere thought of parting ways with your physical wallet, a repository for indispensable items such as your driver's license, seems incomprehensible.

In embracing the digital frontier and bidding farewell to the conventional wallet, it can be difficult for many when facing a world that’s quickly going digital, like it or not. Your mobile phone can cover an array of transactions, from grocery purchases and parking fees to dining experiences and insurance coverage.

Currently, not every establishment you walk into is digital only. For those who have embraced the use of a digital wallet, their view is if a store doesn't offer Tap to Pay, they won't be receiving their business. Fortunately, such encounters are increasingly rare, and getting smaller, as the vast majority of establishments, ranging from large-scale retailers to quaint local businesses, now accommodate various forms of mobile payments through platforms like Apple Pay and Venmo.

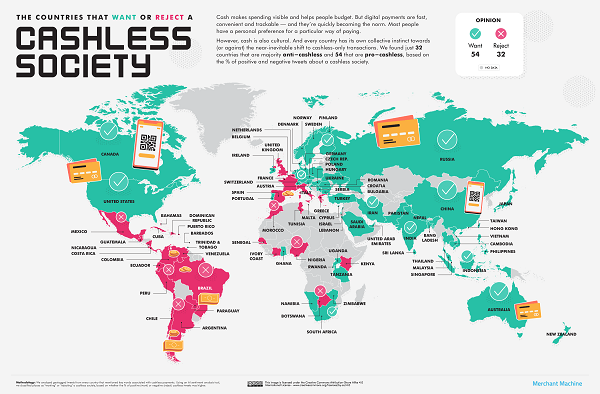

Cashless Society. Courtesy of: Digital Information World

Why has the digital direction increased in its use?

The coronavirus pandemic sped up digital payment developments across the world, and the United States was no exception. The United States saw a bigger increase in NFC penetration than other countries worldwide.

What is NFC: It’s an acronym for ‘near-field communication’ and is a set of communication protocols that enables communication between two electronic devices over a distance of 4 centimeters [1.5 inches] or less. NFC offers a low-speed connection through a simple setup that can be used to bootstrap capable wireless connections.

In 2021, more than four out of 10 U.S. smartphone users had used a contactless payment at least once. NFC is one type of mobile payment, a category that can include mobile wallets used in a physical store, QR code payments, or smartphone transactions. PayPal, especially, is popular in the United States but, although both are classed as a “mobile payment” option, function somewhat differently. Regardless, many U.S. consumers experienced mobile payments for the first time during the pandemic to avoid the use of paper currency as well as debit and credit cards.

The concept of a cashless society is becoming a reality, with digital payments becoming increasingly popular among Gen Z with Gen X following suit.

A recent survey identified that 35% of 18-24-year-olds have increased their usage of digital banking services since the beginning of the Covid-19 pandemic, indicating that Gen Z are driving a shift away from traditional payment methods. Instead of cash, they are opting to use contactless payments, digital wallets, banking apps and cryptocurrencies.

Payment by mobile. Courtesy of: Fineksus

The payments landscape has shifted dramatically in the past decade, with digital payments leading the race. Gen Z and Millennials desire quicker and more convenient payment methods. People in these age groups are known for their technological proficiencies, with many not recalling a time without online services and mobile phones.

With technology playing a big part in their daily life, it’s not surprising that these groups are choosing to benefit from the speed and convenience of using alternative payment methods.”

Furthermore, half of these individuals are keenly interested in leveraging their smartphones for purposes beyond mere financial transactions, as indicated by recent findings from Pymnts Intelligence, a reputable research entity specializing in commerce studies.

The younger demographic increasingly relies on their smartphones to fulfill tasks traditionally associated with physical wallets, such as storing essential documents like driver's licenses, boarding passes, and event tickets. While certain digital items seamlessly integrate into popular wallet apps like Apple and Google, others, such as insurance cards, requires downloading through third-party applications.

This shift in consumer behavior reflects the remarkable evolution of mobile wallet technology. A decade ago, during the developing stages of mobile payment app development, widespread skepticism prevailed, as tapping a phone on a scanner offered little discernible advantage over swiping a credit card.

However, recent years have witnessed a dramatic transformation, happening in part by the global pandemic, which propelled society towards contactless payment solutions. Expanding their software capabilities, industry giants like Apple and Google now facilitate the digitization of driver's licenses and transit cards, culminating in a convergence of factors that significantly enhance the utility of mobile wallets.

For those contemplating a departure from traditional wallets or seeking to minimize pocket clutter, here's a comprehensive guide to aid in your transition.

When it comes to payments, utilizing Google Pay for Android users and Apple Pay for iPhone aficionados, allows seamless transactions by tapping their phones on designated readers adjacent to cash registers across numerous retail outlets. Even smaller enterprises, such as food trucks, have embraced the convenience of third-party apps like Venmo, enabling patrons to scan barcodes to execute payments easily.

I recall going to a wine festival and checking out the various artisans and food stands. Would you believe very few would take cash, not even a check. It was digital payment or nothing.

Nevertheless, entrusting one's financial transactions to a mobile wallet carries inherent risks. Limiting your possessions to just your phone enhances potential losses in the unfortunate event of a mugging. There’s also the risk of someone breaking into your mobile wallets via unauthorized access and the worry of thieves coercing individuals into divulging their passcodes and draining funds from their accounts.

To safeguard against such threats, iPhone users are advised to activate a newly introduced security feature, Stolen Device Protection, which is accessible through device settings. This feature prevents unauthorized access to sensitive data, including passwords and stored credit card information, particularly in unfamiliar locations. Similarly, Android users are encouraged to familiarize themselves with protocols for locking and purging data from their devices in the event of theft.

As we migrate to a digital world, we also discover some of the attributes that are a bit irritating, such as tipping. While the convenience of Apple Pay proves efficient for transactions at

fast-casual eateries where payments are made at the counter, navigating sit-down restaurants presents occasional challenges. In such establishments, where servers deliver the bill and anticipate traditional credit card payments, we’re now confronted with the ‘expected’ tip prior to paying the bill on those restaurant mini cash registers.

Health insurance cards and other key documents can also be streamlined with your mobile phone.

Adopting digital scans or photographs of vital documents, such as health insurance and car insurance cards, has become widespread, serving as viable alternatives to physical copies. Various insurance providers, including State Farm, Aetna, and Anthem, offer digital versions of their cards through dedicated mobile applications, facilitating integration with users' mobile wallets. However, not all insurance cards possess this functionality, and the inconvenience of locating these cards promptly can prove troublesome—especially in urgent situations like navigating through documents after a car accident.

To streamline access to insurance cards, some have consolidated images of all insurance cards into a single digital note stored on the phone. For iPhone users, this process involves opening the desired photo of the insurance card, selecting the Notes app from the options menu, and saving the image to a newly created note titled "Insurance Cards." Similarly, Android users can employ the Google Keep note-taking application to upload the image of their insurance card and label the note accordingly.

In addition to insurance cards, other types of cards and documents—such as public transit cards like the Clipper card, movie tickets, and gift cards—can be digitized. By tapping the "Add to Apple Wallet" button, these items seamlessly integrate into the Apple Wallet app, offering convenient access whenever needed.

Another area that has been migrated to mobile phones is identification documents.

The introduction of digitized driver's licenses represents a relatively novel development, currently undergoing trials in several states nationwide, including California, Arizona, Connecticut, Maryland, and Utah. However, the functionality of mobile wallets encounters limitations in this domain.

In California, for instance, individuals can enroll for a digital driver's license via the California Department of Motor Vehicles app. Upon registration, the app generates a temporary barcode, enabling age and identity verification through scanning. Despite advancements, widespread acceptance of digital IDs remains elusive.

While select airports in certain states display signage indicating acceptance of digital IDs for participants of the Transportation Security Agency's PreCheck program, many states have yet to embrace this initiative fully, rendering it impractical to forego carrying a physical driver's license.

Moreover, the digital ID fails to provide a comprehensive substitute for its physical counterpart. Law enforcement protocols in California dictate that mobile driver's licenses cannot be accepted during routine traffic stops. At the same time, Arizona's Motor Vehicle Division maintains the requirement for individuals to possess a physical ID.

During recent alcohol purchases at various grocery stores, cashiers encountered difficulties with the digital California driver's license, lacking the necessary equipment to scan the barcode for verification.

In critical situations, relying solely on digital identification may pose challenges. While features like Apple's Medical ID and Google's Personal Safety offer avenues to display essential information such as name, age, and emergency contacts via phone shortcuts, familiarity among emergency medical responders remains a potential hurdle.

Recognizing the importance of maintaining a physical ID, individuals may explore alternative methods to carry it without relying on traditional wallets. Some opt to sandwich their ID between their phone and its case, though this approach may inadvertently expose the phone to increased risk of damage upon impact.

A preferred solution: a magnetic wallet affixed to the back of the phone, accommodating only two essential cards — the ID and a credit card.

Imagine a future where digital driver's licenses seamlessly integrate into everyday transactions, signaling the eventual retirement of physical card holders like the one we currently hold in our wallet.

As this digital movement continues, it seems like a forgone conclusion that we, the entire world, will become a cashless world.

What can we learn from this story? What's the takeaway?

Traditionally, cash-driven nations are opting to digitize, with Generation Z fueling the fire. Gen X are bridging the gap between the digital and traditional economies, and many people in this age category are adapting digital technologies such as BNPL, an acronym for Buy now, pay later, a type of installment loan. It divides your purchase into multiple equal payments, with the first due at checkout. The remaining payments are billed to your debit, credit card or bank account until your purchase is paid in full.

Older generations are slowly recognizing the convenience and flexibility of digital technology payments. When looking to the future, FinTech’s must focus on taking a steer to create an easy and simple payment ecosystem of the future.

Well, there you go, my friends; that's life, I swear

For further information regarding the material covered in this episode, I invite you to visit my website, which you can find on Apple Podcasts, for show notes calling out key pieces of content mentioned and the episode transcript.

As always, I thank you for the privilege of you listening and your interest.

Be sure to subscribe here or wherever you get your podcast so you don't miss an episode. See you soon.