USA’s Fiscal Time Bomb Ticks Louder: What Does This Mean for You?

The United States credit rating dropped to AA+ from AAA in August of 2023. The U.S. government will run a budget deficit of $1.5 trillion in 2023, along with a national debt currently hitting $30 trillion!

supporting links

1. Fitch Downgrades the United States' Long-Term Ratings to 'AA+, Outlook Stable [Fitch Ratings]

2. U.S. Debt Clock in real time [U.S. Debt Clock.org]

3. Fitch Ratings [Wikipedia]

4. Majority Of Americans Say Shutdown Is 'Embarrassing for The Country' [NPR]

5. Credit Rating: What It Is and Why It's Important to Investors [Investopedia]

6. National debt of the United States [Wikipedia]

7. Adding up the Cost of Our Never-Ending Wars [POGO]

8. Fast Facts about Medicare and Social Security [CATO Institute]

9. Charting the Rise of America’s Debt Ceiling [Visual Capitalist]

Contact That's Life, I Swear

- Tweet us at @RedPhantom

- Listen to audios:

-Apple https://apple.co/3MAFxhb

-Google https://bit.ly/3L2K4Iu

-Spotify https://spoti.fi/3xCzww4

-My Website: https://bit.ly/39CE9MB - Email us at https://www.thatslifeiswear.com/contact/

- Opening theme song credit: Courtesy of Fesliyan Studios

- If you like to leave a review for an episode, please submit on Apple Podcast or on my website

- Do you have topics of interest you'd like to hear for future podcasts? If so please email us at: https://www.thatslifeiswear.com/contact/

Thank you for following the That's Life I Swear podcast!!

Hi everyone, I'm Rick Barron, your host, and welcome to my podcast, That's Life, I Swear

Approximately two months ago, Aug 1st if you will, the United States credit rating dropped to AA+ from AAA. The U.S. government will run a budget deficit of $1.5 trillion in 2023, and the national debt is currently hitting $30 trillion and climbing! This level of debt is unsustainable. Now what?

Let's jump into this

On August 1, 2023, in a move that sent shockwaves through financial markets, Fitch Ratings recently downgraded the United States' credit rating from AAA to AA+.

Fitch Ratings Inc. is an American credit rating agency and is one of the "Big Three credit rating agencies", the other two being Moody's and Standard & Poor's. It is one of the three nationally recognized statistical rating organizations designated by the U.S. Securities and Exchange Commission.

This adjusted credit rating, accompanied by the projection of a staggering $1.5 trillion budget deficit for 2023 and the ominous forecast of $30 trillion for the national debt, raises significant concerns about the long-term economic sustainability of this nation.

My discussion with you today explores the implications of these developments, the factors contributing to the escalating debt, and the potential consequences if this trajectory is not only stopped but reversed.

First and foremost, the downgrade in the U.S. credit rating is a sobering reminder of the nation's financial challenges. The AAA credit rating is the highest grade assigned to a borrower, indicating a minimal risk of default on its debt obligations. A downgrade to AA+ signals a slightly elevated level of risk, leading to increased borrowing costs for the U.S. government.

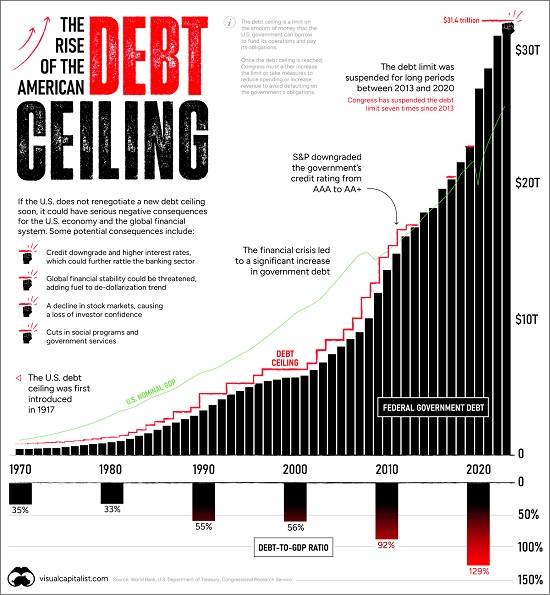

Debt Ceiling infographic. Courtesy of: Visual Captialist

Let me paint you a picture of what we're seeing here. What the American people should get a hold of here is that we're seeing a slow-motion fiscal train wreck, and it's draining capital and putting the American dollar at risk.

Why does this matter?

The downgrade from Fitch is a siren blasting loudly that the United States needs to rethink fiscal and monetary regulatory policies. With Europe, Japan, and China facing sluggish economies, the world sees the United States as vital.

The implications of the downgrade are significant. A lower credit rating means that the U.S. government will have to pay higher interest rates on its debt. The ratings agency lowered the U.S. long-term rating from its top mark and said debt-limit standoffs [aka: shutting down the government game] had eroded confidence in the nation's fiscal management.

This will make it more expensive for the government to borrow money, which will further strain its finances. It could also lead to a decline in the U.S. dollar's value, making imports more expensive and exports less competitive.

The downgrade is a warning to the U.S. government that it needs to take action to address its fiscal problems. The downgrade could lead to a financial crisis if the government does not act.

Financial crisis. Courtesy of: Yahoo Finance

The takeaway from this rating change is the statement from Fitch, and I quote "The repeated debt-limit political standoffs and last-minute resolutions have eroded confidence in fiscal management." End quote

The projected budget deficit of $1.5 trillion in 2023 exacerbates this situation. Budget deficits occur when government spending exceeds revenues, leading to increased borrowing to cover the shortfall. While deficit spending can be justified during times of economic crisis, it becomes problematic when it becomes a consistent pattern, as it can result in an ever-growing accumulation of debt. If left unchecked, this could lead to a vicious cycle of borrowing to service existing debt, leaving fewer resources for important initiatives such as infrastructure, education, and healthcare.

The most alarming aspect of this situation is that this country currently has a $30 trillion national debt. Such a level of debt is unquestionably unsustainable in the long term. It threatens the stability of the U.S. economy, undermines confidence in the government's ability to manage its finances, and raises questions about the nation's overall fiscal responsibility. The burden of servicing this colossal debt could crowd out other essential government functions, potentially leading to reduced public services, increased taxes, or both.

There's a saying. Problems don't come by themselves. A combination of factors got the United States into this position, including:

- Recessions and wars

The U.S. economy has experienced two major recessions in the past two decades and has also fought two wars, one in Iraq and the other in Afghanistan. These events have led to a sharp increase in the national debt. - Tax cuts

The U.S. government has had cut taxes several times in recent years. This has reduced government revenue and made it more challenging to balance the budget. George W. Bush and Donald Trump did this country no favors with its tax cuts. - Spending increases

The U.S. government has increased spending on entitlement programs like Social Security and Medicare. These programs require substantial funding with an aging population and increasing healthcare costs. If comprehensive reforms are not enacted to address the sustainability of these programs, they will continue to strain the budget and contribute to the growing deficit. Bear in mind that Social Security, Medicare and Medicaid, account for approximately two-thirds of all federal spending!

Bear this point in mind. The projected date that Social Security would be insolvent is 2034, eleven years from now. Unless Congress takes action [don't hold your breath] to shore up the program, beneficiaries will receive about 80% of their scheduled benefits after that point. That’s a fair chunk of change to lose, for many who rely on Social Security as their only means of retirement. - Growing interest payments on the existing debt

As the national debt increases, so does the money needed to service it. With a larger budget dedicated to interest payments, this creates a compounding effect, leaving fewer resources for other critical needs.

Furthermore, discretionary spending, which includes defense, education, and other vital government functions, has faced significant pressures in recent years. Balancing the need for investment in these areas with the imperative to control spending is a complex challenge that requires careful consideration and a long-term perspective.

The consequences of an unsustainable national debt are grave and far-reaching.

· A debt crisis could lead to a downgrade of the U.S. credit rating, resulting in higher borrowing costs for the government and potentially causing a financial crisis. The impact on global financial markets could be severe, as the U.S. dollar, a cornerstone of the international monetary system, could lose its status as a safe-haven currency. This increases volatility in global markets, negatively affecting economies worldwide.

· A decline in the value of the U.S. dollar could happen. A lower credit rating could reduce the value of the U.S. dollar, making imports more expensive and exports less competitive, hurting the U.S. economy.

· If the U.S. government does not act to address its fiscal problems, it could lead to a financial crisis. This could happen if the government defaults on its debt or investors lose confidence in the U.S. government's ability to repay its debts.

· Moreover, an unsustainable debt burden hampers economic growth. It limits the government's ability to invest in infrastructure, education, research, and other drivers of long-term economic prosperity. Without such investments, the nation's economic potential may be stifled, leading to lower job creation, reduced innovation, and diminished opportunities for future generations.

How to begin solving this mess

Addressing the challenge of the unsustainable national debt requires a multifaceted approach. It begins with responsible fiscal management, focusing on reducing budget deficits. This may involve a combination of spending cuts in non-essential areas, comprehensive tax reforms, and careful evaluation of entitlement programs.

Like it or not, eventually all of us will feel the pain.

Fiscal headaches for the American citizen. Courtesy of: USA Today

It also necessitates a commitment to economic growth, as a vibrant and expanding economy generates increased tax revenues and reduces the relative burden of the debt.

Additionally, a balanced approach to addressing the debt must involve bipartisan cooperation. A consensus on the importance of fiscal responsibility, coupled with thoughtful policy solutions, is essential to navigate the complex challenges ahead. Political will and a commitment to putting the nation's long-term interests first are critical components of any effective strategy.

In conclusion, the recent downgrade of the U.S. credit rating to AA+ from AAA, along with the projection of a $1.5 trillion budget deficit in 2023 and a $30 trillion national debt, raises significant concerns about the sustainability of the nation's fiscal path. It is crucial to recognize the gravity of this situation and take decisive action to address it.

Failure to do so could have severe consequences for the U.S. economy, global financial stability, and the prosperity of future generations. It is a challenge that requires prudent fiscal management, responsible policy decisions, and a commitment to the nation's long-term well-being.

What can we learn from this story? What's the takeaway?

This country needs to get its house in order. Not tomorrow, or next month or next year…NOW! Both the Democrats and the Republicans are quickly, if not already, painting themselves and this country into a fiscal corner we may not be able to escape.

Sooner or later, painful decisions will need to be made, and brother, that day will arrive. We've dug a deep hole that to do nothing is juvenile. This ongoing careless infighting and uncertainty keep taking the United States, the world's largest economy, to the brink of default.

We can play chicken only so long. The only thing resolved this year was an agreement that postponed the day of reckoning until 2025 to decide how we deal with our fiscal responsibilities. Yes, the kicking of the proverbial tin can down the road continues. Hell, why not? We've got plenty of time.

Well, there you go, my friends; that's life, I swear

For further information regarding the material covered in this episode, I invite you to visit my website, which you can find on either Apple Podcasts/iTunes or Google Podcasts, for show notes calling out key pieces of content mentioned and the episode transcript.

As always, I thank you for listening and your interest.

Be sure to subscribe here or wherever you get your podcast so you don't miss an episode. See you soon.